Growing up in a relatively middle-class, military family, money wasn’t something that I often thought about. My parents both worked on base (as did the families of many of the other kids I knew), we bought all of our groceries at a discount at the Commissary, and “fashion” consisted of whatever we could scrounge together from what had been shipped into the local Base Exchange (BX) that month. Most of my friends and neighbors lived in the same boxy high-rise condos designed in on-base housing, and we all went to the same Department of Defense schools. If I was lacking anything, I didn’t know it.

Every military kid knows that rank is important. One memory from my childhood is knowing and being able to list the various ranks of each of my friends’ parents off the top of my head – just in case. I recall elementary-school whispers about the off-base “mansion” that the Colonel lived in (it probably was closer to a modest ranch-style), and remember wistfully admiring his daughter’s new dresses, latest American Girl dolls, and the fact that they had a live-in nanny. This was certainly the closest that I had come to encountering wealth. Despite this, our community was tight-knit, and when there was a need, we all pulled together.

It wasn’t until later in life that I became aware that, in fact, many military families struggle with financial difficulties and even food insecurity. This became more evident when I was 12, and my family moved from overseas to Fairfax County, Virginia, one the wealthiest counties in the nation.

In comparison, my parents had both grown up in working-class, blue collar families. My grandparents were hardworking and came from very humble backgrounds – a legacy of barbers, house painters, pastors, and housekeepers. Their goals were to get by and make a better life for their children, the same wishes that my parents had for my brother and me. And, in their case, money was often discussed – mostly because there never seemed to be enough of it.

As a first-generation college student, I spent a lot of time hearing about the importance of going to college, studying hard, obtaining my degree, and finding a “good” job (which, presumably, paid lots of money). Ironically, something that I didn’t hear about was how to prepare myself for financial wellness and security. It was assumed that this was something that I’d learn in school or figure out once I’d “made it.” After all, my parents, and their parents, had made a way — even without the traditional schooling and resources that I, a Millennial in the age of Google, Fin-Tech, and Wikipedia, have access to on an almost instantaneous basis.

Financial literacy is a term that has gained greater attention over the last several decades, particularly as the wealth gap continues to widen. It includes a variety of financial topics and concepts, such as personal finance, budgeting, investing, retirement and real estate.

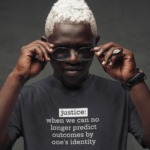

According to a study conducted by BNY Mellon and Pershing, 63% percent of consumers were unable to answer at least four out of five questions on a financial literacy quiz correctly. There is an even greater gap when demographics such as age, race, and gender are considered, and there have also been pronounced differences identified between emerging and developing economies. This is not surprising when we consider the historical and current systems and barriers that have served to disenfranchise women, people of color, and other marginalized groups. Slavery, Jim Crow segregation, lack of educational resources, racial and gender-based pay inequity, and other forms of structural oppression have all played a role in creating and sustaining the wealth gap and perpetuating poverty.

Slavery, Jim Crow segregation, lack of educational resources, racial and gender-based pay inequity, and other forms of structural oppression have all played a role in creating and sustaining the wealth gap and perpetuating poverty. Click To TweetWhen I was growing up, I did not have a class that taught me how to open a checking or savings account, the best way to manage my budget and balance my accounts, or how to invest. When I applied for student loans and assistance for college, I relied on the Internet and a few friends whose parents had gone to university and could help me navigate the process. When I graduated from college and started my first job, I remember the anxiety I felt around seemingly simple things such as selecting my insurance benefits and electing a contribution to my 401(k). My parents helped the best they could, but they weren’t always equipped to help me through topics such as investing or the stock market.

Financial literacy is a currency and language that should be accessible to all. Click To TweetFinancial literacy is a currency and language that should be accessible to all. Today, only 1/3 of the states in the U.S. require a financial literacy course prior to graduation, leaving financial knowledge to chance. Without access to these important resources, students are moving into college, and possibly the workforce, without the knowledge they need to make critical decisions.

Financial literacy and broader education efforts have both been called out as avenues to help advance equity, support economic development, and reduce economic inequalities. And, although increasing financial education and access to resources are certainly not the only actions needed, it can be one of the first steps to building a more fulfilling and stable foundation for life – and supporting our own communities to move forward.

Although increasing financial education and access to resources are certainly not the only actions needed, it can be one of the first steps to building a more fulfilling and stable foundation for life - and supporting our own… Click To TweetWhen did you first discuss “money matters”? Is money discussed openly in your family or community?